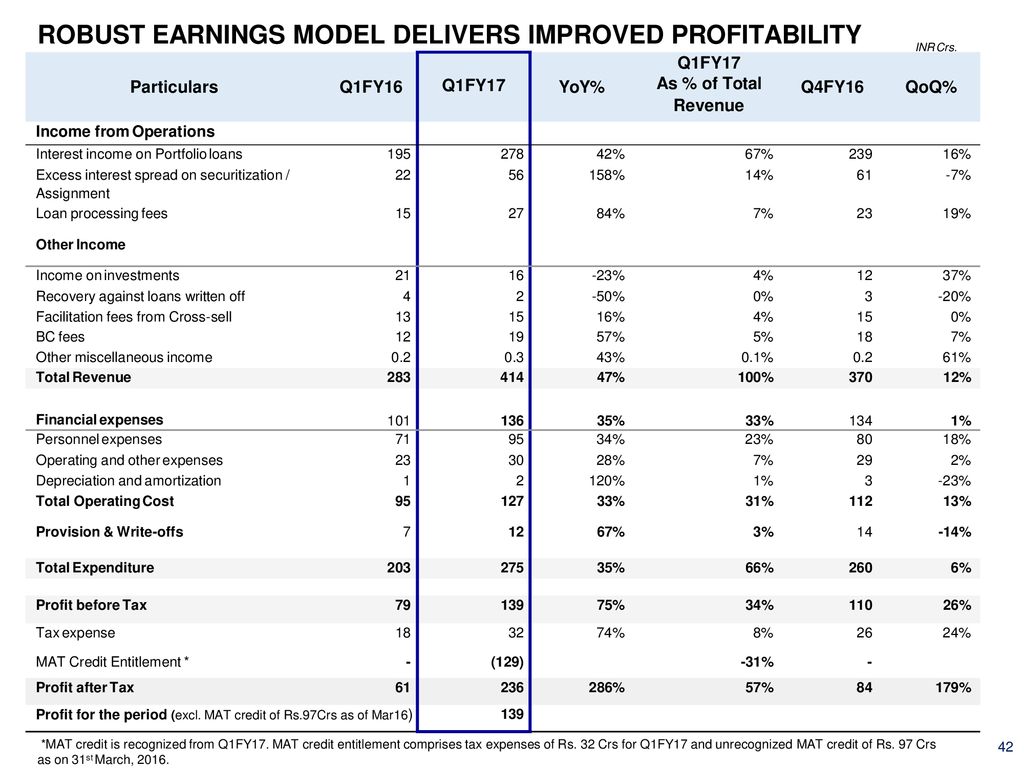

Provision for taxation a c dr.

Mat credit entitlement example.

The difference arising out of mat paid and mat credit entitlement can be treated as tax paid during the year.

According to paragraph 6 of accounting standards interpretation asi 6 accounting for taxes on income in the context of section 115jb of the income tax act 1961 issued by the institute of chartered accountants of india mat is the current tax.

100 tax as per mat rs 80 tax as per normal provisions i e.

Such excess of tax credit is allowed to be carried forward and set off in the financial year in which the company is liable to pay tax under the general provisions of the income tax act.

Mat credit is rs 20.

Allowed a huge amount and in some cases where set off could be claimed but the a o.

Tax liability of a company for fy 2019 20 under normal provisions of the income tax act is rs.

The unavailed amount of mat credit entitlement if any should continue to be presented under the head loans advances.

Profit loss account.

Since the company is liable to pay mat the company can avail the difference of the tax payable as per mat and tax payable as per normal provisions as mat credit.

This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.

Mat credit entitlement will be treated as an asset and the accounting will be done by crediting the profit loss a c if there is a virtual certainty that the company will be able to recover the mat credit entitlement in future limited period.

Moreover the mat credit set off can only be to the extent of the difference between the regular corporate tax and mat liability calculated.

Ans when the amount of minimum alternate tax mat for a company is greater than its normal tax liability the difference between mat and normal tax liability is called mat credit.

Rejected the set off.

To mat credit entitlement a c further mat credit is to be reviewed at each balance sheet date.

While writing down the mat credit entitlement following entry is to be passed.

A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under when a company pays tax under mat the tax credit earned by it shall be an amount which is the difference between the amount payable under mat and the normal tax.

It must also be noted that deferred tax charge is not covered by any other clause of the explanation to section 115jb 2 and is therefore not required to be added back in the computation of book profits for the purpose of section 115jb.

8 lakh while the liability as per the provisions of mat is rs.

Profit loss a c dr.

It will be disclosed under loans and advances.

The following entry is to passed mat credit entitlement a c dr.

For more information on mat credit refer to this article.

Rs 14 43 000 rs 12 48 000 rs 1 95 000.

This mat credit can be carried forward and set off for 10 consecutive assessment years succeeding the year in which the tax credit first accrued.

To profit loss a c cr.

In the above case mat credit rs.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.